A Special Purpose Acquisition Company

Targeting the Life Science Companies that Enable and Support Innovation

Advantage

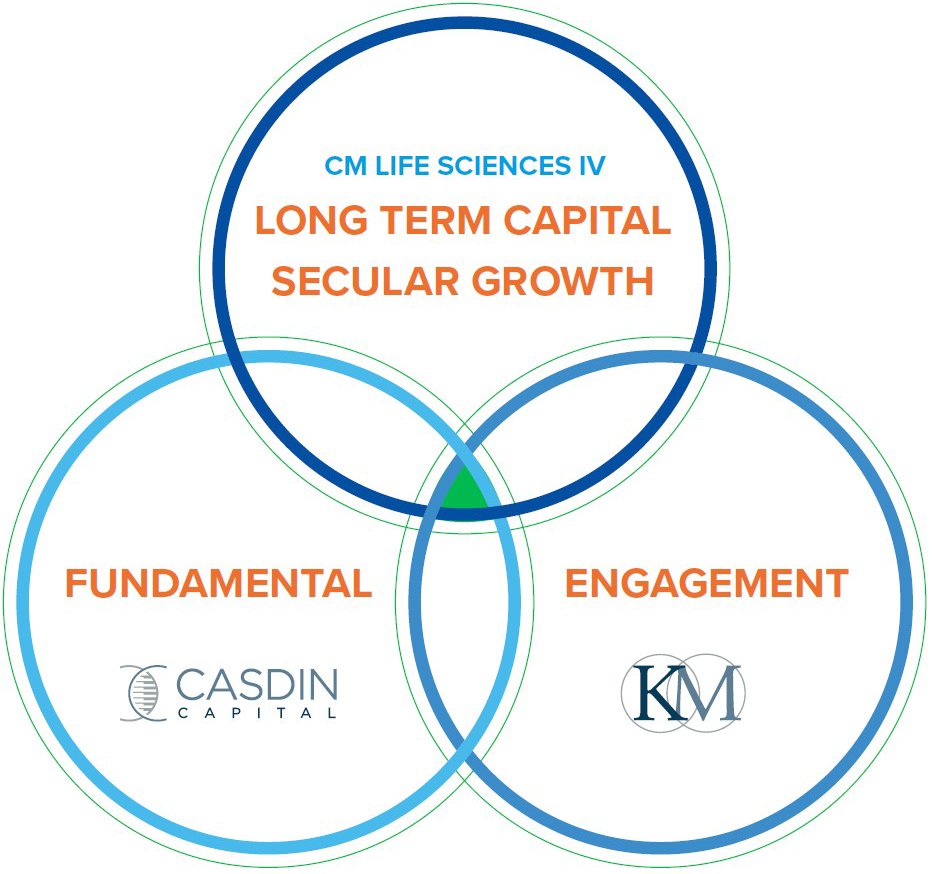

Synergy: Eli Casdin’s Investment Platform, Keith Meister’s Capital Markets & Board Expertise

Since 2012, Eli Casdin and his investment team’s returns have flowed from their reputation, built over years, as investor-partners, working from the inside to drive and support new developments. Their tireless, on-the-ground research, close relationships with the brightest scientists and management teams and investments focus on the long-term. Their industry connections now include hundreds of critical business builders, specialists, and innovators, which we believe will allow CM Life Sciences IV to push forward into new opportunities while also capturing value overlooked, or left behind.

Keith Meister has an extensive history of creating value and effecting change at companies, by creating buy-in from management teams, directors, and shareholders. Focused on identifying market dislocations and adept at spotting differentiated points of view, Mr. Meister and the Corvex Management team have built success based on deep industry understanding and a willingness to take the longer term view while capitalizing on market inefficiencies. Prior to founding Corvex Management, Mr. Meister was Chief Executive Officer / Principal Executive Officer of Icahn Enterprises, a NYSE listed diversified holding company, where he grew assets from $1.5 billion to $18 billion while generating greater than 20% annual returns for shareholders. Mr. Meister has served as a director of 15 public companies and helped those companies structure and execute over $80 billion in transactions including spin-offs, asset sales, mergers, acquisitions and various forms of capital market transactions.

CM Life Sciences IV was founded to take advantage of a dynamic life science sector buoyed by innovation yet fragmented, where many companies are under-resourced and under-scaled. Significant and under-appreciated opportunities for consolidation are ready for engagement by a team versed in the trends and themes, and who can bring together the strongest of the new companies and management teams to capitalize on near- and far-term opportunities. CM Life Sciences IV is bringing together the unique industry experience, operational expertise, and investment savvy of Eli Casdin and Keith Meister.

Opportunity

Research

Diagnose

Develop

*Revenue estimate for 2020

Investment Opportunities

OPPORTUNITY: The innovation-productivity cycle in life sciences is creating enormous and varied opportunities across the development continuum and ecosystem.

Ecosystem

Services and tools supporting drug discovery, development and manufacturing.

Identifying operationally focused companies with regulated products and services that have long and lucrative life cycles.

Life Science

Tools

High value tools and services for R&D across academia, government and industry.

Tremendous opportunity to combine workflows and solutions to create powerful synergies and growth.

Synthetic

Biology

New markets exploiting technological advances in engineering of biological systems.

From human health to industrial markets the syn-bio manufacturing platform is the future few appreciate.

Diagnostics

Molecular diagnostics industry now realized with limited public opportunities for exposure.

Imbalance between channel and content capabilities creates synergy opportunities.

Board of Directors

Eli Casdin – CEO

INDUSTRY LEADER IN LIFE SCIENCE INVESTING

Eli Casdin, Chief Investment Officer and Founder, founded Casdin Capital in 2011, which manages $3.3B, targeting public and private growth equity in the life sciences ecosystem. For the last 17 years, Eli has analyzed and invested in disruptive technology and their application, by developing a deep understanding of the disruptive technologies and from cultivating relationships with industry leading experts and scientists since the beginning of this industry. Prior to founding Casdin Capital, Eli was a vice president at Alliance Bernstein “thematic” based investment group where he focused on the implications of new technologies for the life science and healthcare sectors. He published the black book, “The Dawn of Molecular Medicine” detailing the accelerating wave of innovations in life sciences, and the next wave.

Keith Meister – Chairman

SIGNIFICANT EXPERIENCE AS OWNER/OPERATOR AND PUBLIC COMPANY BOARD MEMBER

Founder and CIO of Corvex Management, which manages $2.5bn, targeting high quality businesses that can benefit from constructive shareholder engagement, while generating a 20% annual return for shareholders. Served as director of 15 public companies and helped structure and execute over $80bn in transactions. Previously Vice Chairman and CEO of Icahn Enterprises. During Keith’s tenure assets grew from $1.5 billion to $18 billion while generating substantial shareholder returns. Served as director of 15 public company boards. History of creating shareholder value through improved corporate governance, capital allocation and operations.

Tara Comonte – Board Member

Tara Comonte has been CEO of TMRW Life Sciences, Inc., the creator of the world’s first and only robotic and SaaS platform for automated cell management platform in the fast-growing in vitro fertilization (IVF) sector, since May 2021. Tara was a founding member of TMRW’s Board of Directors in 2018 and is a passionate advocate for driving innovation and accelerated use of technology to benefit women’s health and the broader fertility sector. TMRW’s platform is being implemented across leading IVF clinics in the US in 2021 and will expand commercial operations to the UK and Europe in 2022. Previously President and CFO at Shake Shack (NYSE: SHAK), the high growth, global, publicly traded restaurant chain, Tara was instrumental in the company’s accelerated implementation of people- and customer-first digital and technology solutions, resulting in significant value creation, and oversaw a host of additional enterprise-wide technology initiatives. Prior to Shake Shack, Tara held C-level positions at large public and private equity owned media companies, including Getty Images and McCann Worldgroup, part of Fortune 500 public company Interpublic Group (NYSE: IPG). Tara received a B.A. in Accounting and Finance from Heriot-Watt University.

Michael Egholm, Ph.D. – Board Member

Michael Egholm, Ph.D., was the Chief Technology Officer of Danaher Life Sciences and created and led Danaher’s corporate venture fund from 2017 until September 2021. Previously, he was the President of Biopharmaceuticals at Pall Corporation since 2014, and joined Pall as its Chief Technology Officer in 2010. Dr. Egholm has over 25 years of proven leadership in developing and commercializing innovative technologies and previously served as Chief Technology Officer at 454 Life Sciences Corporation, the first company to successfully commercialize Next Gen Sequencing (NGS). Prior to joining 454, Dr. Egholm held senior R&D positions with Molecular Staging and Applied Biosystems. Furthermore, Dr. Egholm is an elected member of the Royal Danish Academy of Sciences and Letters, a named inventor on numerous patents, and co-author of many high profile papers. Michael currently serves as a director of Isoplexis and Abbratech. Michael earned his Ph.D. In chemistry from University of Copenhagen.

Demetrios Kouzoukas – Board Member

Mr. Kouzoukas is a member of the Board of Directors for Clover Health. From 2017-2021, he was the Chief Executive of the Medicare program at the Centers for Medicare & Medicaid Service, where he worked with providers, insurers, and manufacturers to ensure equitable access to health care. As manager of the largest healthcare payor in the U.S., he delivered lower payment error rates year over year, brought about reductions in Medicare Advantage premiums, and rewired policies and operations in response to the COVID pandemic. From 2003-2009, he played a leading role in the Department’s broad portfolio of agencies and activities, from the FDA to the Office for Civil Rights, while serving first as Deputy General Counsel and then Associate Deputy Secretary at HHS. He was appointed to the Administrative Conference of the U.S. to represent the public as an expert in public administration and health benefits. Mr. Kouzoukas received a B.A. in Political Science/Public Policy from The George Washington University, and a J.D. from the University of Illinois College of Law.

Summary

Big Market

- Life Sciences is an enormous addressable market undergoing massive secular growth and ripe for consolidation.

- Broad universe of private companies with intrinsically valuable assets and defensible IP.

Strong Team

- Casdin’s network and deep sector expertise are matched with Meister’s track record of creating value at large, public companies.

- Top tier independent directors enhance industry connectivity and operational experience.

Unique Platform

- CMLS IV leverages Casdin proprietary deal flow and reputation as leading investor in the public and private life sciences market.

- With over 90 private company investments, Casdin has built a deep pipeline and a network of respected venture partners, research institutions, scientists and entrepreneurs.

Ideal Structure

- CMLS IV provides needed capital and a unique buy-and-build strategy for growing Life Science companies which find it hard to access public capital markets but need to scale.

- Public currency enables business owners to participate in upside as CMLS IV platform grows and create a next generation life science platform.